It's that time of year again!! Here are a few tips to guide us through our shoeboxes full of receipts!! I posted this last year, but I figured there's no expiration on timely tax advice .................

Small Business Tax Basics, excerpted from allbusiness.com

Taxes are one of the most important issues facing small businesses. And like a company's profits, its annual tax bill will, in part, reflect the owner's skills and knowledge. Business owners need to be sure that they are meeting all their responsibilities to the tax authorities — and also seizing every legitimate opportunity to reduce their taxes.

Writing It Off: Deductions

Businesses can deduct all "ordinary and necessary" business expenses from their revenues to reduce their taxable income. Some deductions are obvious — expenditures in such areas as business travel, equipment, salaries, or rent. But the rules governing write-offs aren't always simple. Don't overlook these potential deductions:

Trips that combine business and pleasure. If a business trip is primarily devoted to business, deduct the travel costs, as well as other business-related expenses.

Purchases financed by business loans or credit cards. These costs can be deducted this year even if they won't be paid off until later. Deduct the interest on the loans themselves, as well.

Startup expenditures. Only a portion of expenses related to starting up a business can be deducted — $5,000 of general startup costs, and $5,000 of organizational costs. Additional expenses must be amortized over 180 months once the company is up and running.

Employee Taxes

If a business has employees, a variety of taxes will have to be withheld from their salaries. Among them are:

Withholding. Social Security (FICA), Medicare, and federal and state income taxes must be withheld from employees' pay.

Employer matching. Businesses must match the FICA and Medicare taxes and pay them along with employees.

Unemployment tax. Businesses must pay federal and state unemployment taxes.

Read Payroll Taxes for Your Small Business for more detail.

Quarterly Estimated Taxes

This area trips up many entrepreneurs, and is especially vexing for home-based businesses. Failure to keep up with estimated tax bills can create cash flow problems as well as the potential for punishing IRS penalties. Among the issues are:

Who should pay? A business probably must pay quarterly estimated taxes if the total tax bill in a given year will exceed $500.

How much should you pay? By the end of the year, either 90 percent of the tax that is owed, or 100 percent of last year's tax must be paid (the figure is 110 percent if a business's income exceeds $150,000). Businesses can subtract their expenses from their income each quarter, and apply their income tax rate (and any self-employment tax rate) to the resulting figure (their quarterly profit).

Sales Taxes

Most services remain exempt from sales tax, but most products are taxable (typical exceptions are food and drugs). If a business sells a product or service that is subject to sales tax, the business must register with the state's tax department. Then taxable and nontaxable sales must be tracked and included on the company's sales tax return.

Important Tax Deadlines for Businesses

April 15 isn't the only important tax date. The following deadlines are also important to keep in mind:

Annual returns. Annual returns are due April 15 for unincorporated companies.

Estimated taxes. Estimated taxes are due four times a year: April 15, June 15, September 15, and January 15.

Sales taxes. Sales taxes are due quarterly or monthly, depending on the rules in your state.

Employee taxes. Depending on the size of your payroll, employee taxes are due weekly, monthly, or quarterly.

Corporations. The due date for corporations with a calendar tax year is March 15. If a corporation follows a fiscal year, taxes are due two-and-a-half months after the end of the fiscal year.

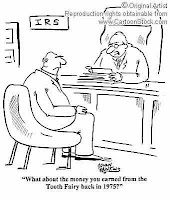

Cartoon

No comments:

Post a Comment